Utilize PortfolioOne for its wide range of features and seamlessly integrate modules into your current ecosystem. The platforms components can be licensed individually or collectively, providing a right-sized solution for your business while laying a foundation for future growth.

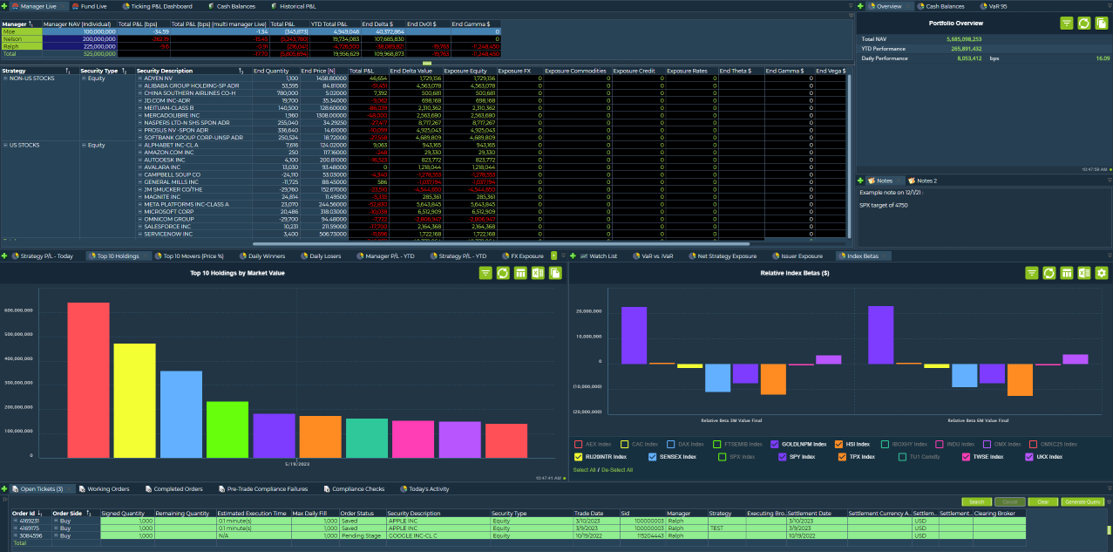

Request a DemoOrganize and track your portfolio in the most natural hierarchy – YOURS. Our flexible tagging environment provides customizable attribution of all aspects of your portfolio both live and historically.

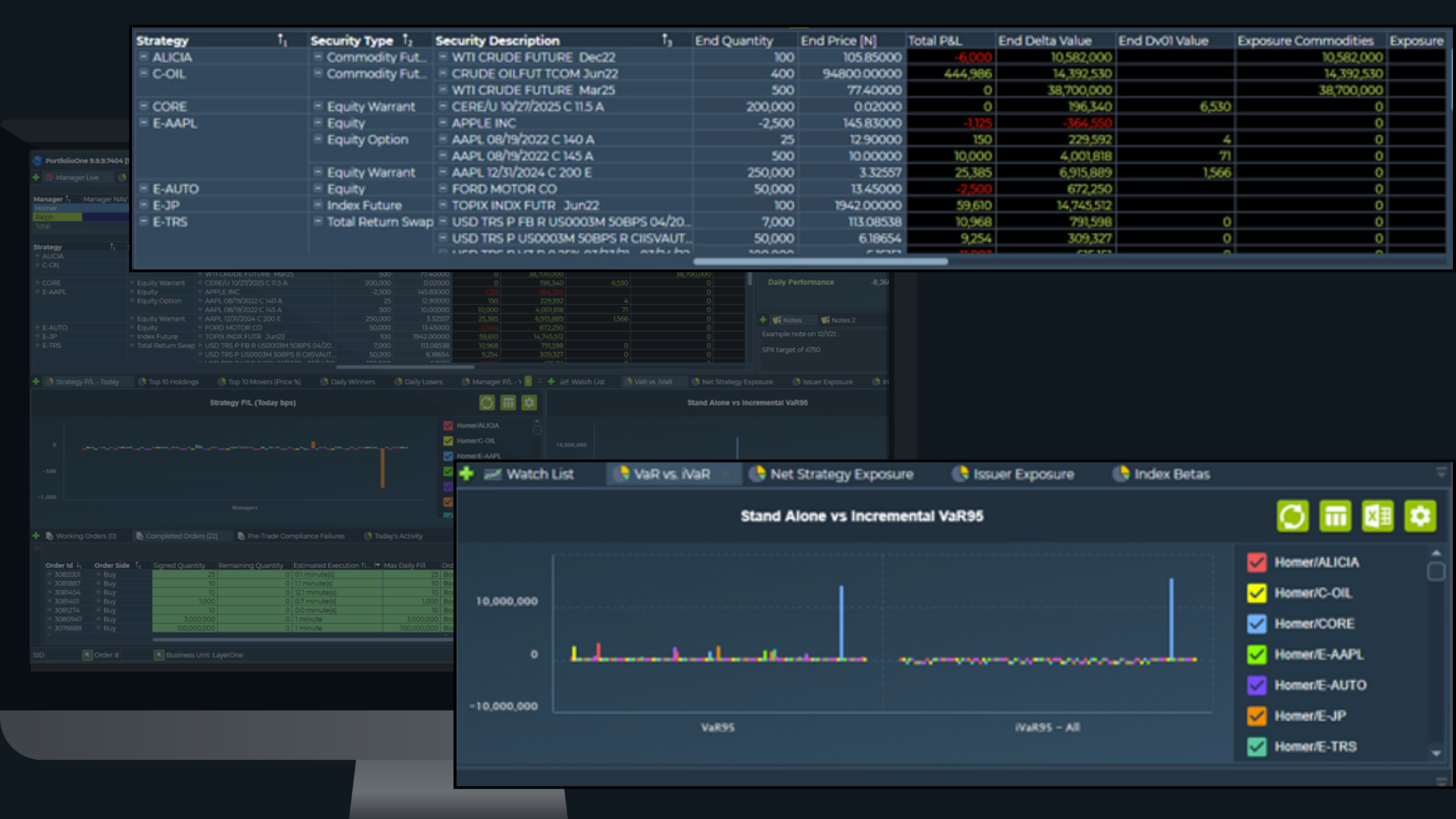

Investment book of record (IBOR): Provides immediate visibility into global cash and across multi-asset positions.

Real-time P&L: Offers a simplified yet powerful window into your current exposure and profit/loss.

Shadow net asset value (NAV): Verifies pricing accuracy and allows for timely correction of discrepancies.

Decision support: Standardizes scenario definitions and can accommodate additional bespoke scenarios to support your investment decision making.

Exposures: Configure unlimited set of tags and custom calculated fields to organize and enrich your portfolio, enhancing your ability to organize, visualize and analyze your strategies and positions.

Greeks and sensitivities: Generate and import analytics and factors using our full analytics library.

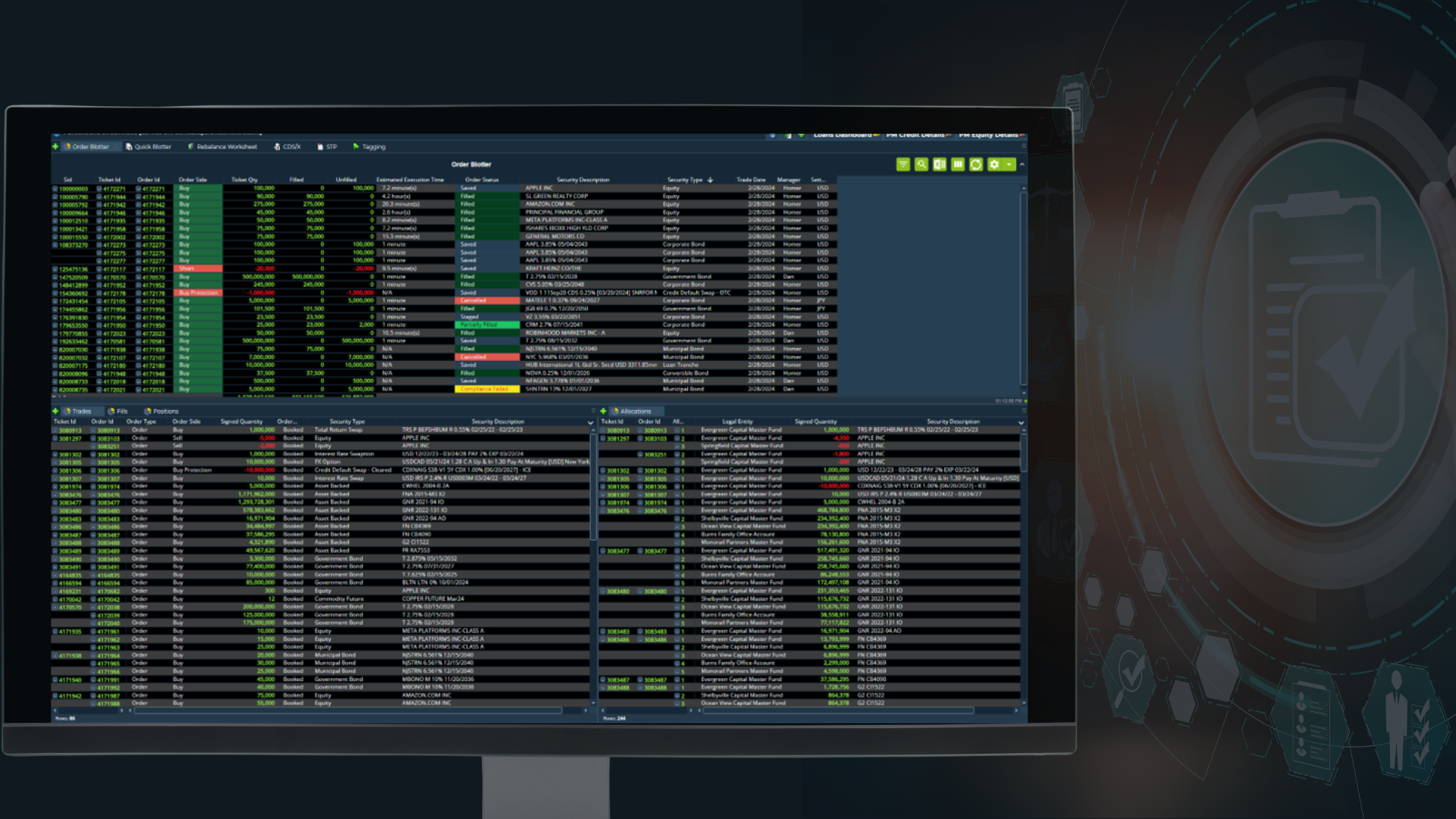

This module provides firms with control over rebalancing portfolios and originating trades to mitigate exposure to market risks and to meet fiduciary responsibilities. Integrate proprietary data throughout the system for display, custom calculations, and risk controls.

Portfolio rebalancing: Inject cash, adjust weightings, and readjust exposure in a few clicks.

Rules engine: Self-service pre-trade rules engine that gives you control over configuration based on compliance considerations.

Order aggregation: Optimize order generation through aggregation and automated pre-trade allocations.

Order marking: Position marking which can split orders and auto-adjust trades.

Short locates: Update shortable quantities and short locates from prime brokers.

Fees and commission: Capture additional costs accurately, and in detail.

Cash generation: Analyze cash ladders, cash history, and projected cash.

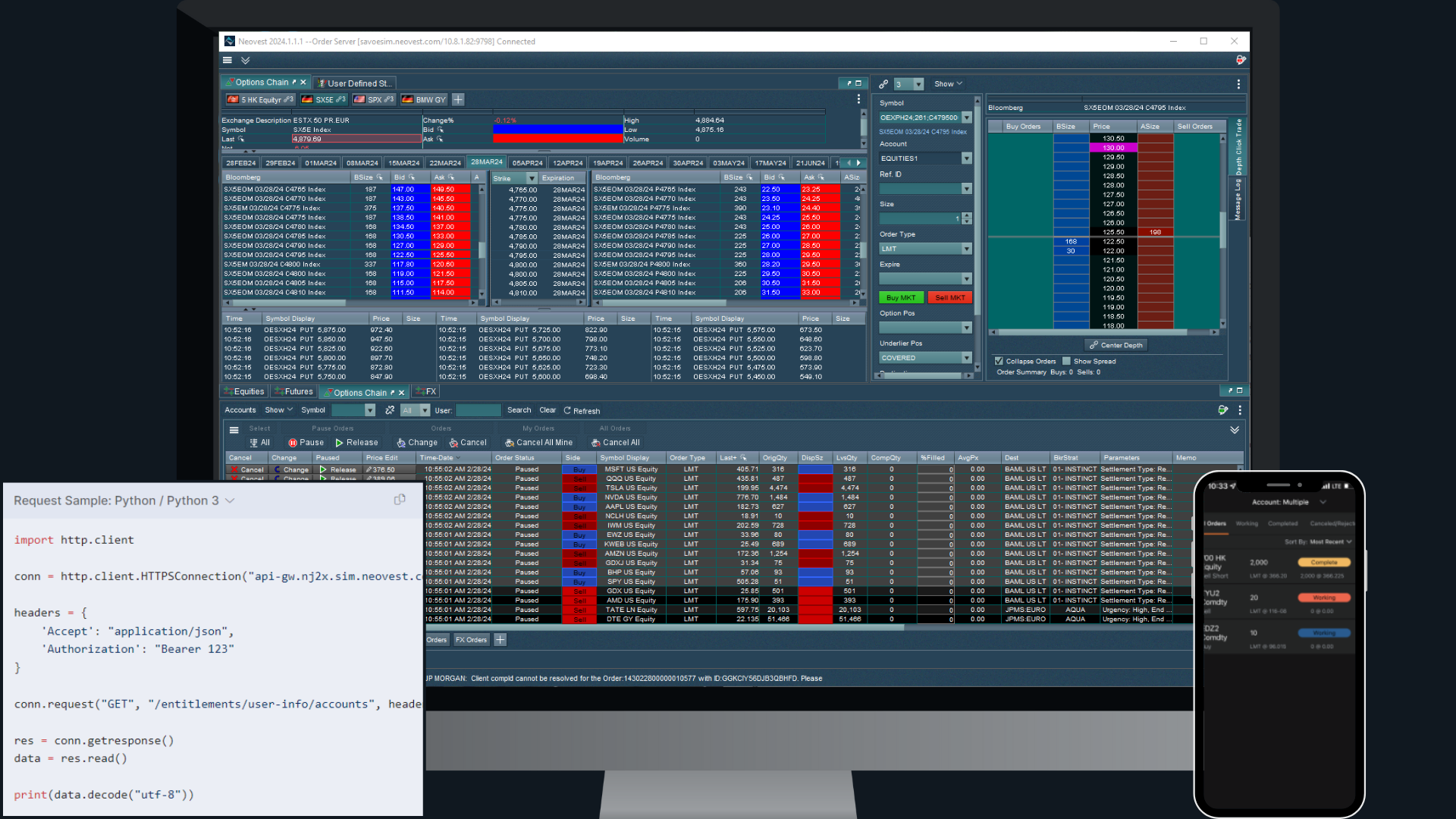

Our sophisticated and intuitive trading platform makes it easy to view market information, track trade data and manage order execution.

Seamless workflows: Allow Portfolio Managers and Traders within the same hedge fund to route orders to each other on PortfolioOne. Keeping both views in sync real time.

Broker connectivity: For fast delivery of your orders to our extensive 340+ broker network using high-touch connectivity, algorithms, or basket orders. With easy to enable shortcuts, for even fewer clicks.

Multi-leg strategies: Integrated broker algorithms for advanced strategies like pairs, user defined strategies, and multi-leg futures trading.

Wheel: Automate your ability to select your brokers and strategies.

API: Systematically route orders or a list of orders while using Neovest to monitor exceptions.

Facilitate regulatory compliance through a fully- linked security and position master with the power to transform portfolios to meet the requirements of Form PF, CPO-PQR, AIFMD Annex IV, and similar global regulatory filings. Manage security or issuer ownership thresholds, maintain multiple restricted trading lists, and track trading limits from a single platform.

Surveillance: Integrated surveillance for record keeping and oversight.

Reporting: Streamlines report generation and internal sign-off across Form PF, CPO-PQR, and AIFMD Annex IV with standard templates.

Ownership monitoring: Generate disclosure reporting consistent with regional requirements.

Restricted lists: Prevent instruments from trading in specific accounts or across aggregated groups.

Audit trail: Accurately attributes and saves all actions to specific individuals.

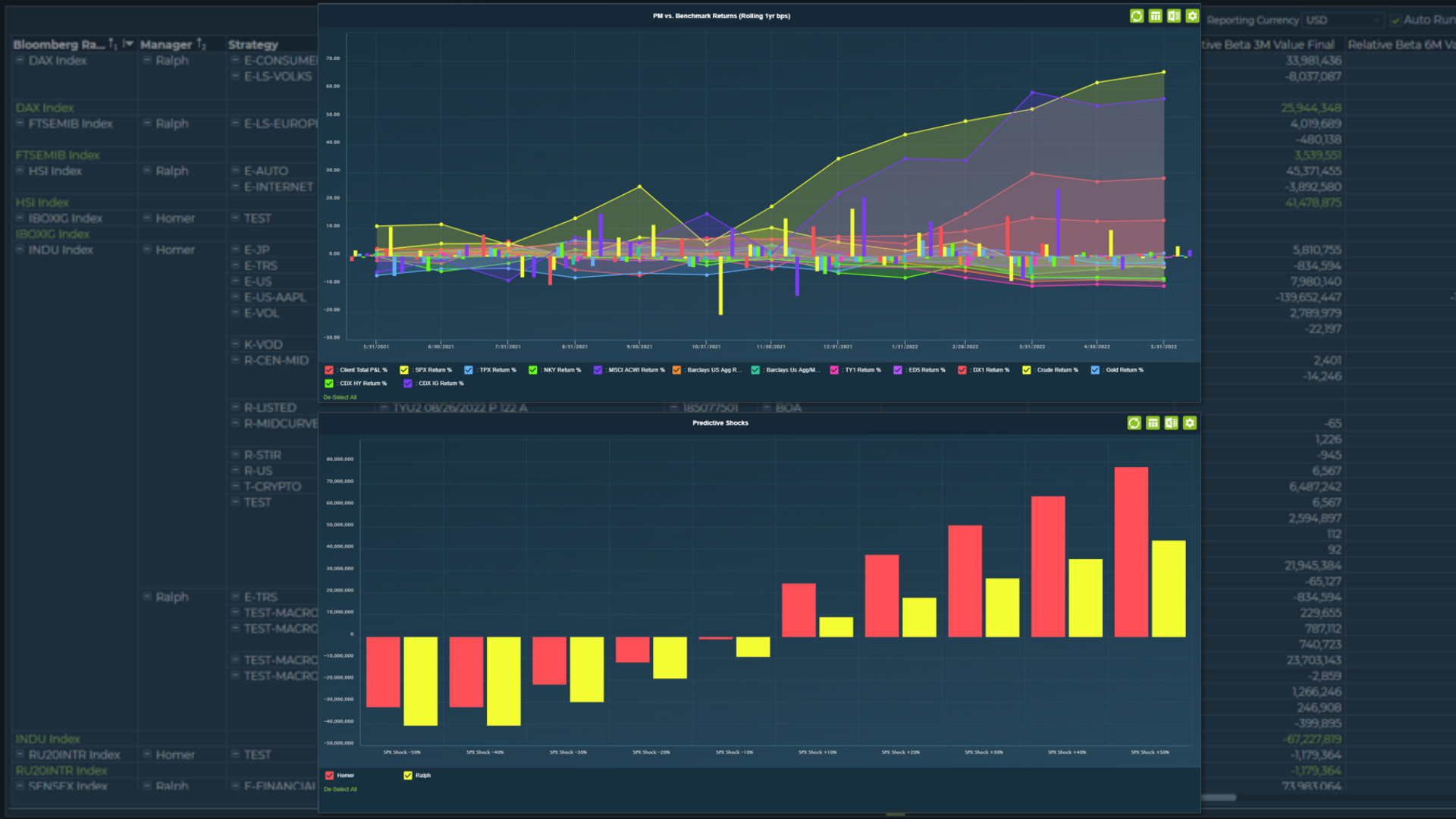

Evaluate risk analytics such as derivative sensitivities, standardized and bespoke market shocks, and optional real-time Value at Risk (VaR). All components share a common analytic layer providing consistent results across all modules and reports. Monitor mandate-specific risk limits and use our alerting module as an early-warning system to detect potential breaches.

Portfolio modelling: Configure models for specific objectives and risk tolerances.

Valuation:Construct price master, model prices, and use multiple valuation modes.

VaR, volatility and betas: Slice and dice risk data, monitor mandate-specific limits and use our alerting module as an early-warning system.

Stress tests: Scenario definition language to create bespoke portfolio shocks and historical scenarios to analyze the impact.

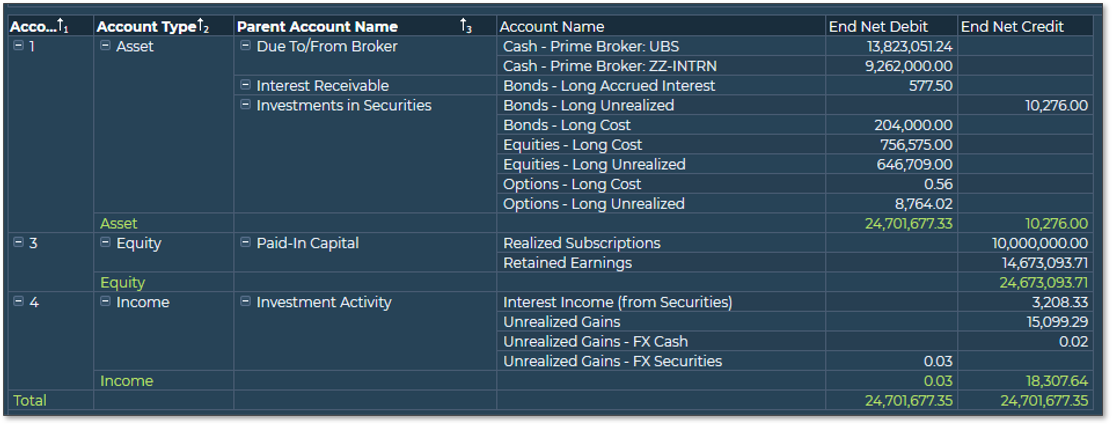

Our platform enables seamless post-trade workflow—from admin to analytics—to improve operational efficiency.

Lifecycle events: Obtain timely operational data -- including trade details, security terms and conditions, with both historical and live information.

Corporate actions: Manage against potential transcription errors, or stale security data with our global security master.

Reconciliation: Automate cross-asset trade capture, improve operational efficiency, and reduce errors with our straight-through-processing engine.

Third-party integrations: Allow prime brokers and custodians to receive the day’s trading activity in a seamless manner.

Chart of accounts: Accommodating of any structure.

Trial balance: Prepare periodically for reporting periods.

Balance sheet: To create snapshots of your company's financial position.

Income statement: For reporting of financial performance.

Integrated portfolio data plays a crucial role in both internal and external reporting. With PortfolioOne, there is no need to cross-reference data from different systems.

Security master: Delivers accurate, pre-populated terms and conditions for millions of globally traded assets and their corresponding issuer relationships.

Reference data: Fully extensible account master, and dynamic granular strategy tagging.

Data warehouse: Provides functionality with both UI and API access to pivot position, execution, cash, security, reference, exposure, and performance/return data across your business.

Affirmation and confirmation: Provides operational efficiency and T+0 accuracy across asset classes.